Open House. Open House on Saturday, December 2, 2017 2:00PM - 4:00PM

New property listed in Uptown NW, New Westminster

Open House. Open House on Saturday, December 2, 2017 2:00PM - 4:00PM

Open House. Open House on Sunday, December 3, 2017 2:00PM - 4:00PM

I have sold a property at 9135 NORUM RD in Delta

Home Inspections and Real Estate in Vancouver

First time home buyers often have a lot of questions around home inspections in the Vancouver real estate market. Often, these questions focus on the nature of home inspections, what is included, and why they are conducted. Home inspections are an important factor in real estate transactions and ultimately protect both the buyer and seller, but many banks or lenders may also request a home inspection.

Let’s start with the basics – a home inspection is simply an expert survey of all aspects of a home, inside and out. Qualified home inspectors check exterior and interior components and structures including the foundation, basement, roof, heating, plumbing and electrical to ensure the home is in good condition. Sellers are not necessarily required to submit to an inspection, but this may mean the buyer is not interested in pursuing the sale. That being said, there are some strata properties that might restrict inspector access to certain areas of a building (such as roof or boiler room) due to liability or warranty concerns.

Home inspectors may act on behalf of the buyer or the seller – so, whoever has requested the inspection will receive the final report. Sellers often decide to get a home inspection so they are prepared for any repairs that may need to be made in advance of selling. Alternatively, buyers ask for inspections so they know that the home is in good repair and no major projects are on the horizon. Not surprisingly, the results of a home inspection can have a significant impact on the selling price of a home.

In reality, home inspections are rarely a requirement of a real estate transaction, unless of course your bank requests it. However, home inspections are always recommended by real estate professionals in Vancouver. Home inspections not only tell the buyer that the home is free from major problems, but also gives them valuable information about the kinds of renovations that may or may not be possible. And as mentioned, if a buyer’s home inspection report indicates significant repairs are required, this can be used in negotiating the final selling price.

So, if you are considering buying a home in the Vancouver real estate market, you should also carefully consider getting a home inspection.

At the end of the day, a home inspection will give you peace of mind knowing that the home you are purchasing will be comfortable for you and your family for years to come. If your inspection comes back suggesting major repairs are required, you have the necessary information to decide whether you would prefer to purchase a different home or if you want to try to get that home for a more affordable price.

Open House. Open House on Saturday, November 18, 2017 2:00PM - 4:00PM

Open House. Open House on Saturday, November 11, 2017 2:00PM - 4:00PM

Open House. Open House on Sunday, November 12, 2017 2:00PM - 4:00PM

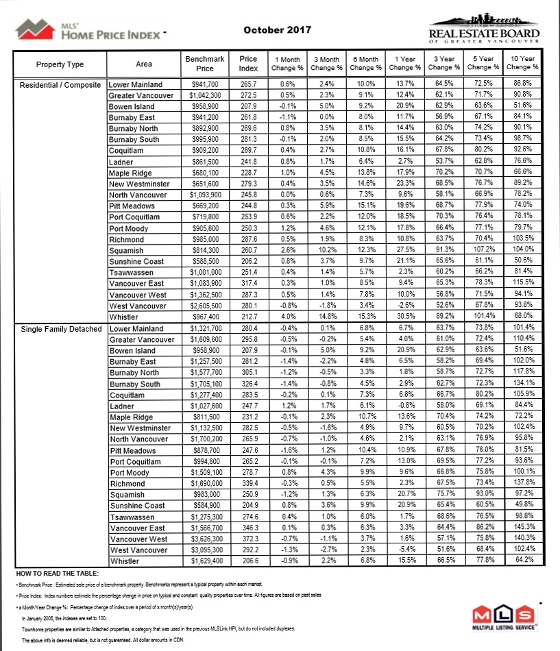

Monthly Statistical Reports - October 2017

OCTOBER SALES EXCEED HISTORICAL AVERAGE!

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in the region totalled 3,022 in October 2017, a 35.3 per cent increase from the 2,233 sales recorded in October 2016, and an increase of 7.1 per cent compared to September 2017 when 2,821 homes sold.

Last month’s sales were 15 per cent above the 10-year October sales average.

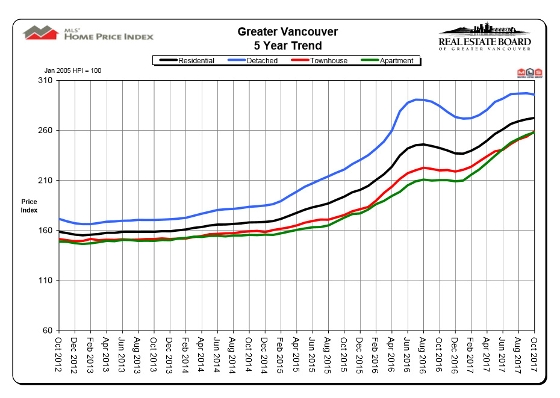

"Conditions continue to vary significantly based on property type. The detached home market is well supplied with homes for sale, which is relieving pressure on prices," Jill Oudil, REBGV president said. "It remains a much different story in the townhouse and apartment markets. Buyers of these properties continue to have limited supply to choose from and are seeing upward pressure on prices."

There were 4,539 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in October 2017. This represents a 14 per cent increase compared to the 3,981 homes listed in October 2016 and a 15.6 per cent decrease compared to September 2017 when 5,375 homes were listed.

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 9,137, a 0.1 per cent decrease compared to October 2016 (9,143) and a 3.5 per cent decrease compared to September 2017 (9,466).

For all property types, the sales-to-active listings ratio for October 2017 is 33.1 per cent. By property type, the ratio is 16.8 per cent for detached homes, 44.8 per cent for townhomes, and 66 per cent for condominiums.

Generally, analysts say that downward pressure on home prices occurs when the ratio dips below the 12 per cent mark for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

"The growth in our provincial economy and job market is contributing to today's demand," Oudil said. "The federal government's announcement of plans to tighten mortgage requirements for the seventh time in the last eight years also helped spur activity in the short term. Many buyers are trying to enter the market before the changes are in place."

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,042,300. This represents a 12.4 per cent increase over October 2016 and a 0.5 per cent increase compared to September 2017.

Sales of detached properties in October 2017 reached 940, a 44.2 per cent increase from the 652 detached sales recorded in October 2016 and a 34.6 per cent decrease from the 1,437 sales in October 2015. The benchmark price for detached properties is $1,609,600. This represents a four per cent increase from October 2016 and a 0.5 per cent decrease compared to September 2017.

Sales of apartment properties reached 1,532 in October 2017, a 30.1 per cent increase compared to the 1,178 sales in October 2016 and a 0.7 per cent decrease from the 1,543 sales in October 2015. The benchmark price of an apartment property is $642,000. This represents a 22.7 per cent increase from October 2016 and a one per cent increase compared to September 2017.

Attached property sales in October 2017 totalled 550, a 36.5 per cent increase compared to the 403 sales in October 2016 and a 17.4 per cent decrease from the 666 sales in October 2015. The benchmark price of an attached unit is $802,400. This represents a 17.7 per cent increase from October 2016 and a two per cent increase compared to September 2017.